Financial Highlights

- Q2 Performance Driven by Revenue Growth Across Recorded Music and Music Publishing

- Cost Savings Plans on Track, With Reinvestment Initiatives Accelerating

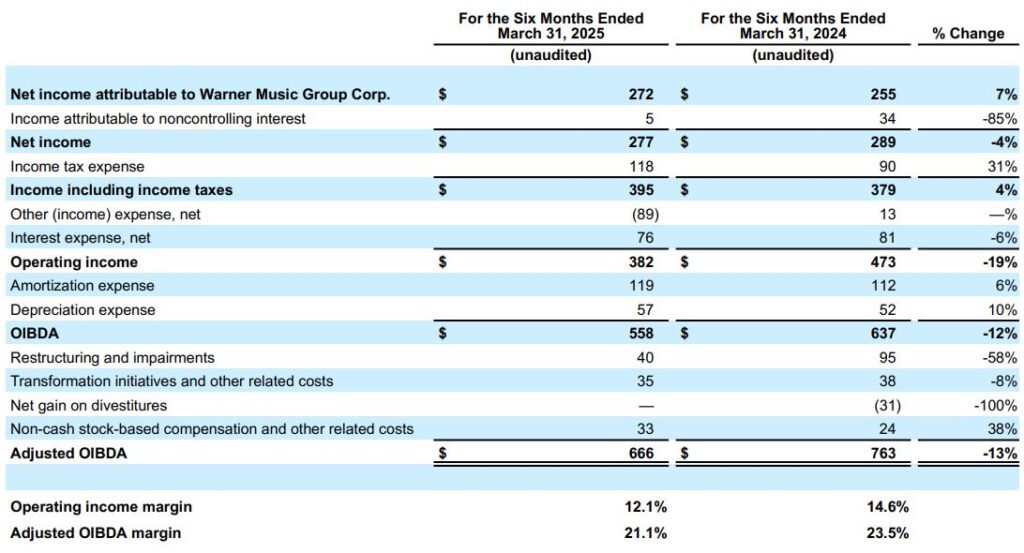

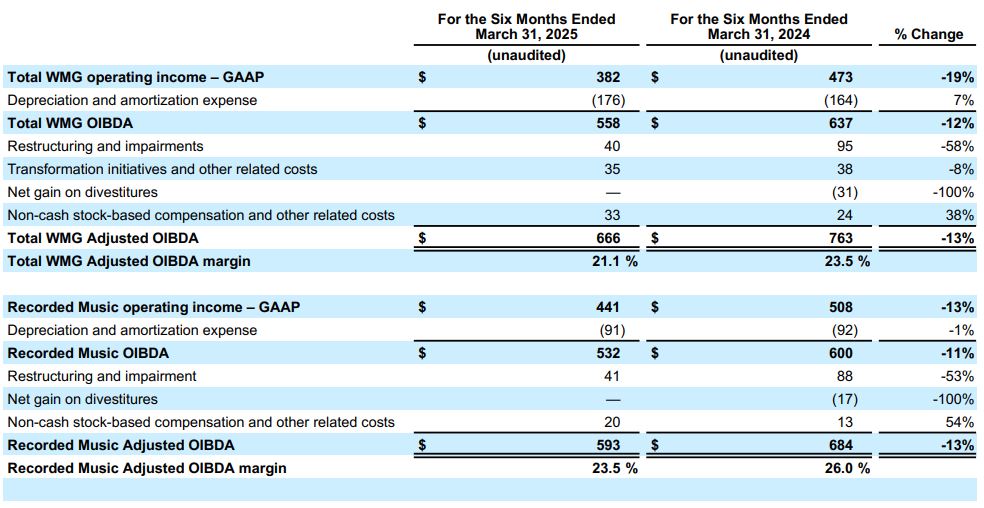

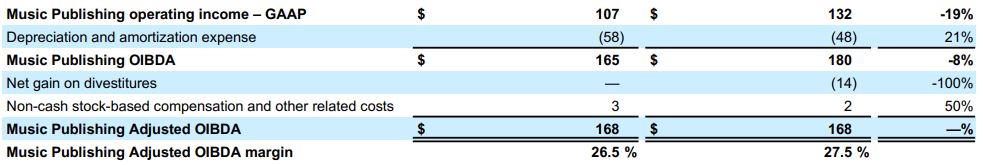

- Year-to-Date Operating Cash Flow and Free Cash Flow Increased by 53% and 59%, Respectively

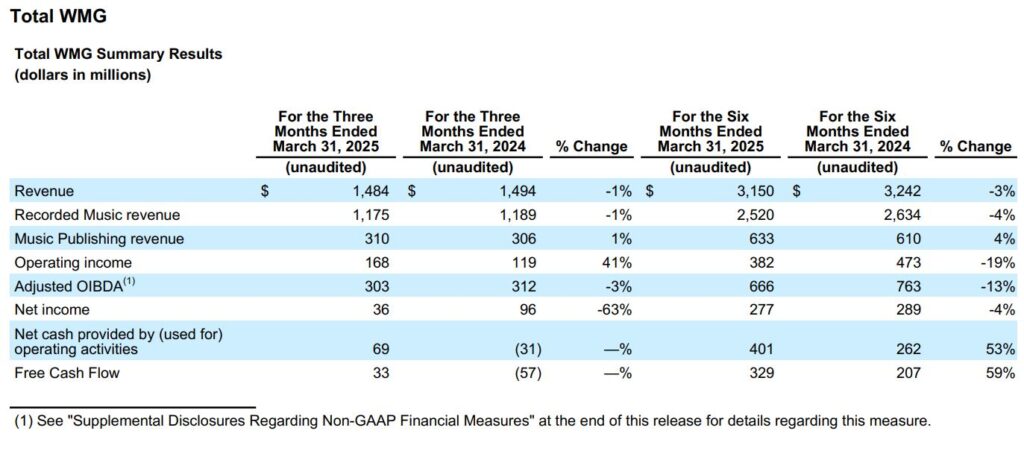

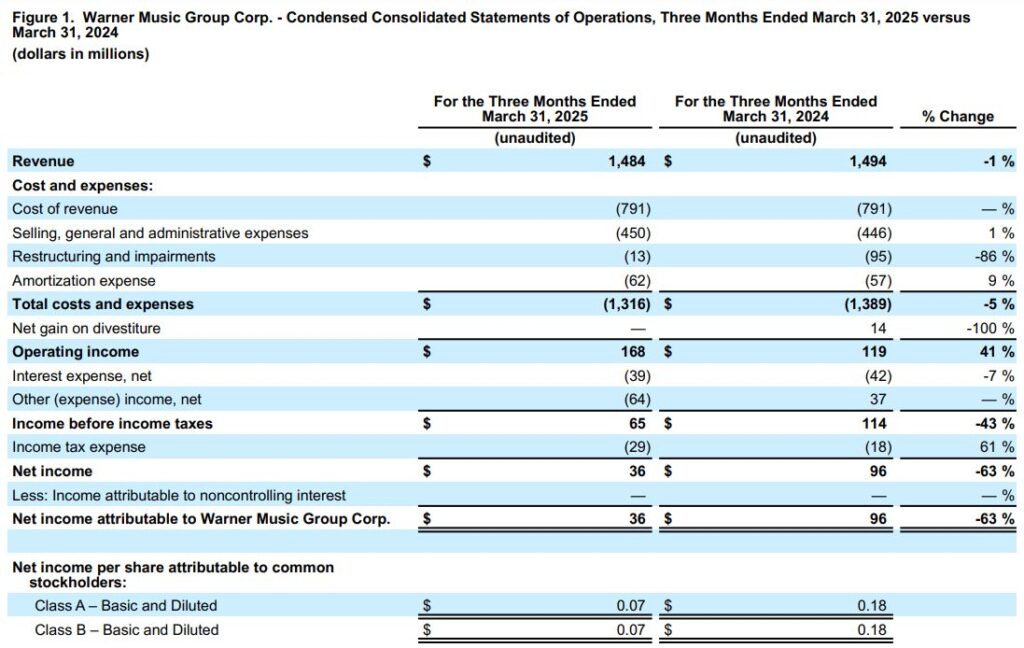

For the three months ended March 31, 2025

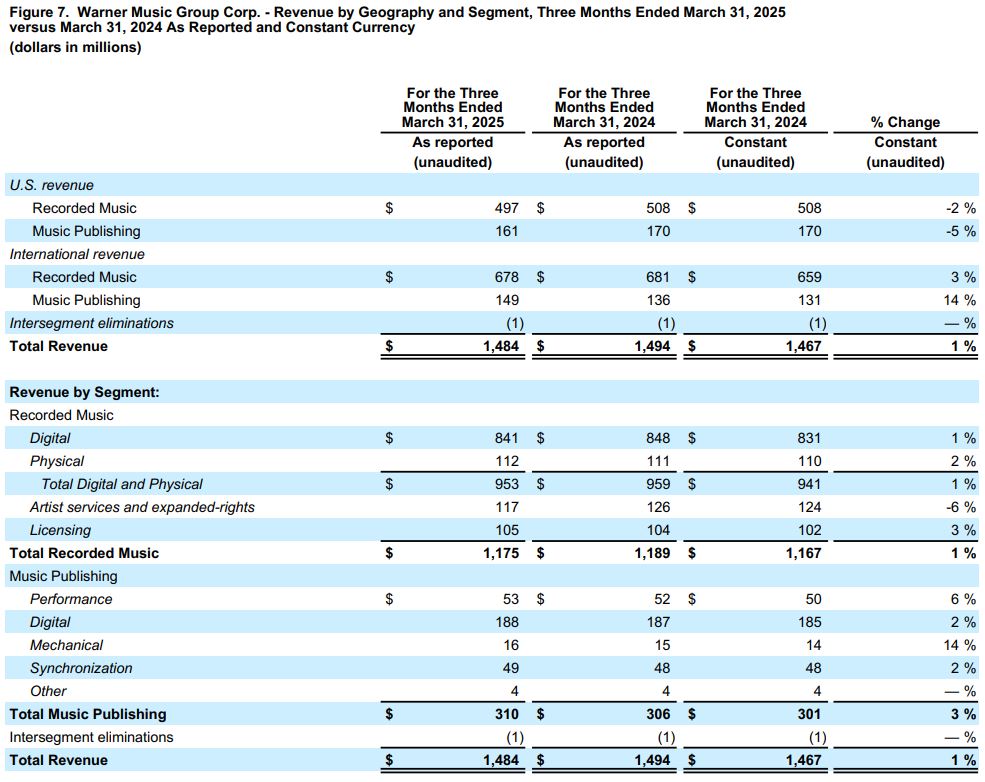

- Total revenue decreased 1%, or increased 1% in constant currency

- Net income decreased 63% to $36 million versus $96 million in the prior-year quarter

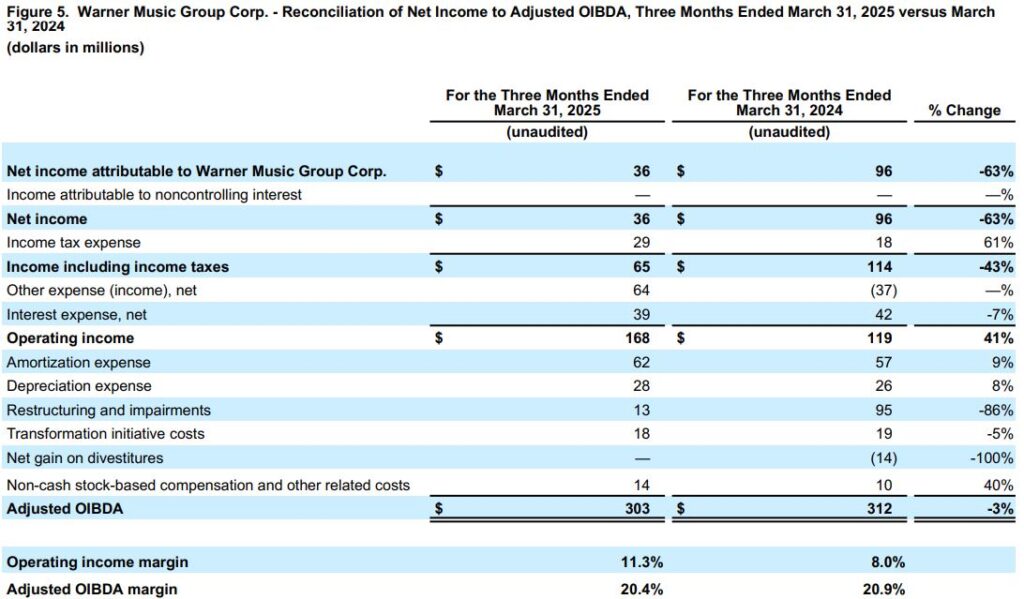

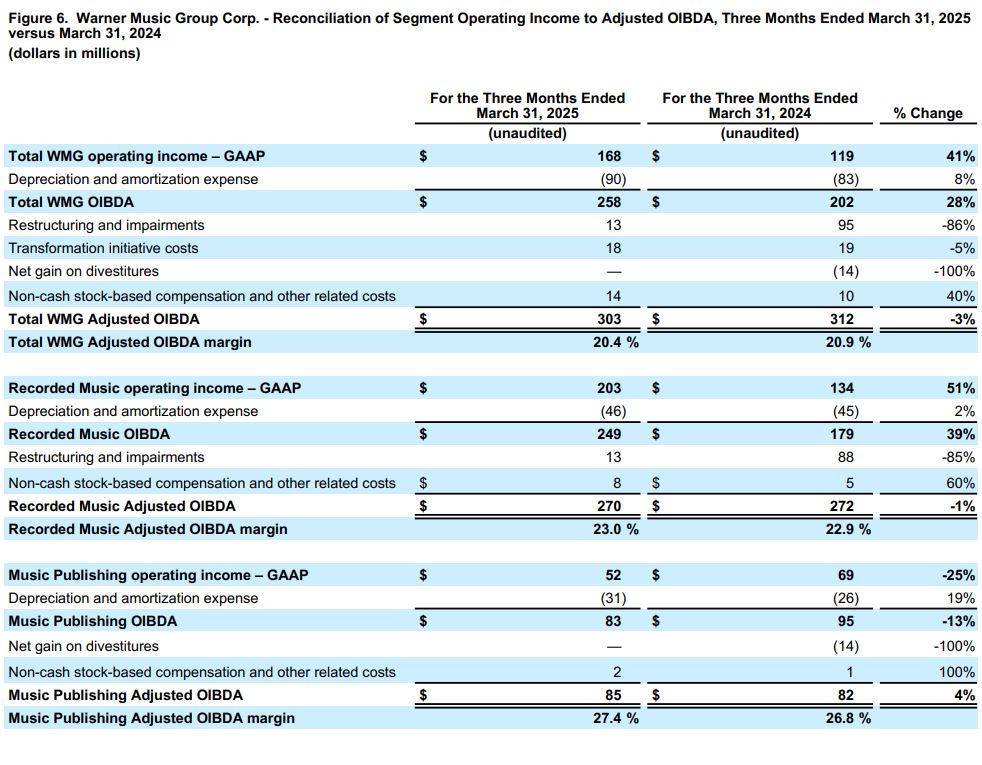

- Operating income increased 41% to $168 million versus $119 million in the prior-year quarter

- Adjusted OIBDA decreased 3% to $303 million, versus $312 million in the prior-year quarter, or 1% in constant currency

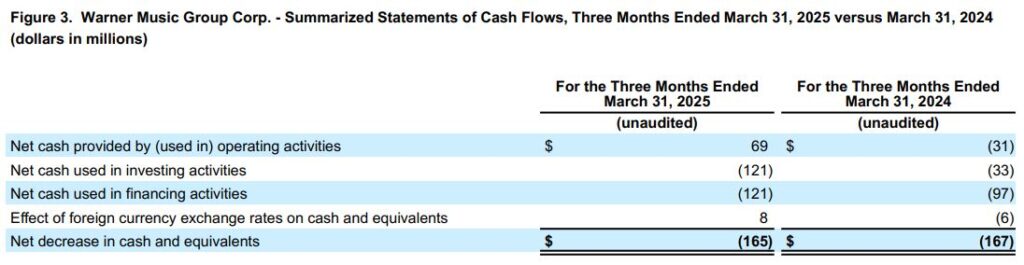

- Cash provided by operating activities increased to $69 million from cash used in operating activities of $31 million in the prior-year quarter

NEW YORK, New York, May 8, 2025 — Warner Music Group Corp. today announced its second-quarter financial results for the period ended March 31, 2025.

“Our strategy is starting to bear fruit, with our strongest chart presence in two years, translating to expanding new release market share in the US. As a result, our true strength this quarter was partially obscured by challenging comparisons with last year’s outperformance. As we replicate our strategy across other labels and geographies, and drive a virtuous cycle of greater reinvestment, we expect to deliver lasting value for artists and songwriters, and sustained growth and profitability for shareholders,” said Robert Kyncl, CEO of Warner Music Group.

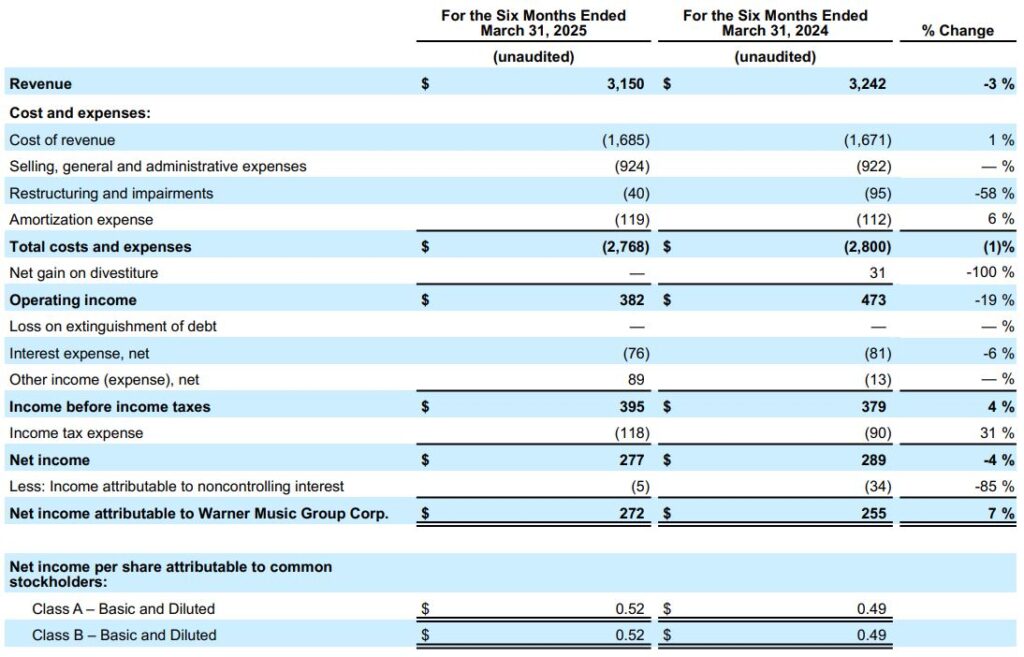

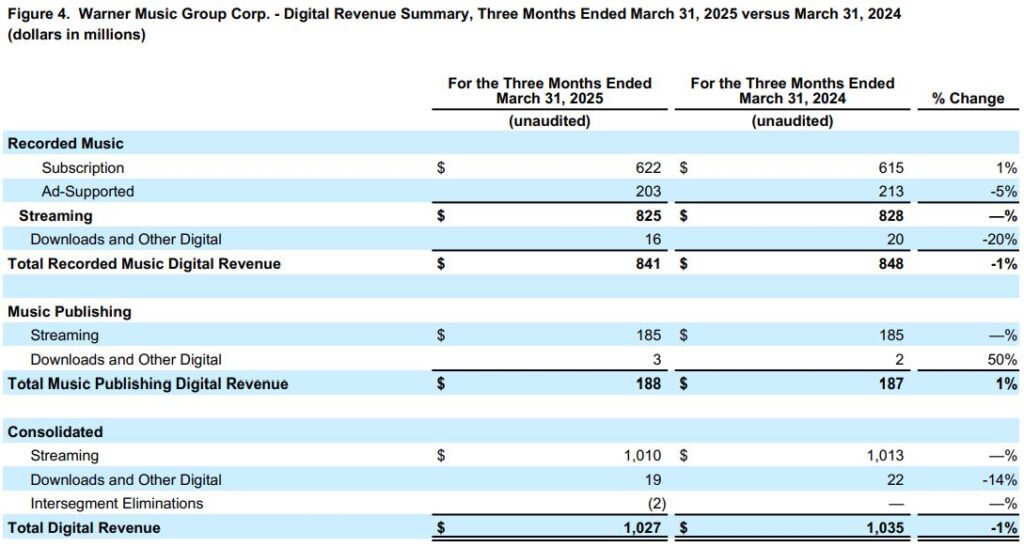

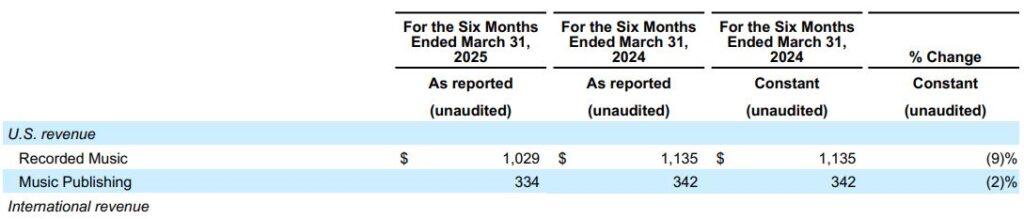

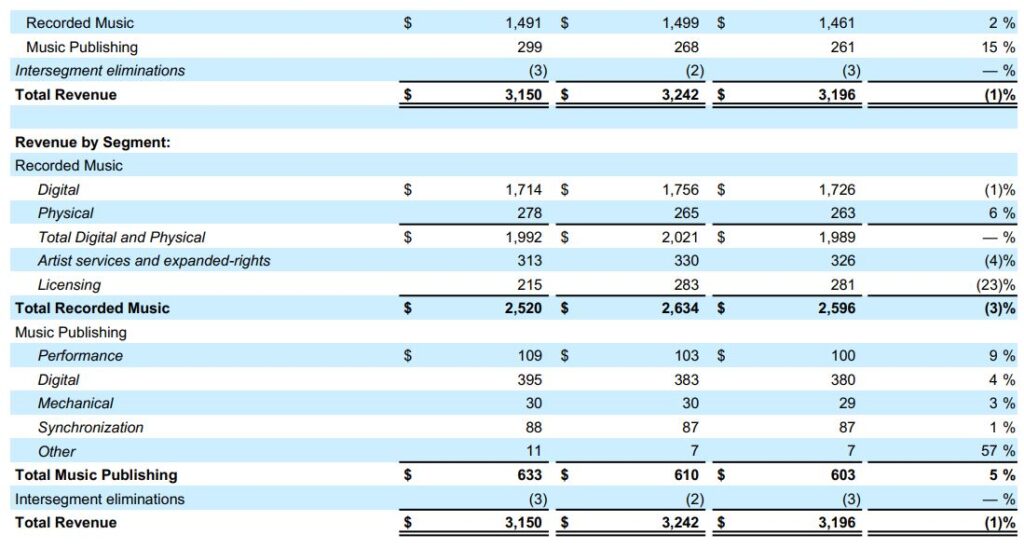

Revenue was down 0.7% (or up 1.2% in constant currency). Digital revenue decreased 0.8% (or increased 1.2% in constant currency), driven by a decrease in streaming revenue of 0.3% (or increase of 1.6% in constant currency). Recorded Music streaming revenue decreased 0.4% (or increased 1.6% in constant currency). Music Publishing streaming revenue was flat to the prior-year quarter (or increased 1.6% in constant currency). The decrease in total revenue was driven by lower Recorded Music artist services and expanded-rights revenue, partially offset by higher licensing and physical revenue and growth across Music Publishing digital, performance, synchronization and mechanical revenue.

Operating income increased 41.2% (or 47.4% in constant currency) to $168 million from $119 million primarily due to the factors affecting Adjusted OIBDA discussed below, as well as a decrease in restructuring and impairment charges of $82 million compared to the prior-year quarter, which includes severance costs and impairment losses related to the Strategic Restructuring Plan, partially offset by higher non-cash stock-based compensation of $4 million in the quarter and the impact of a $14 million net gain on divestitures in the prior-year quarter related to a divestiture of certain music publishing rights.

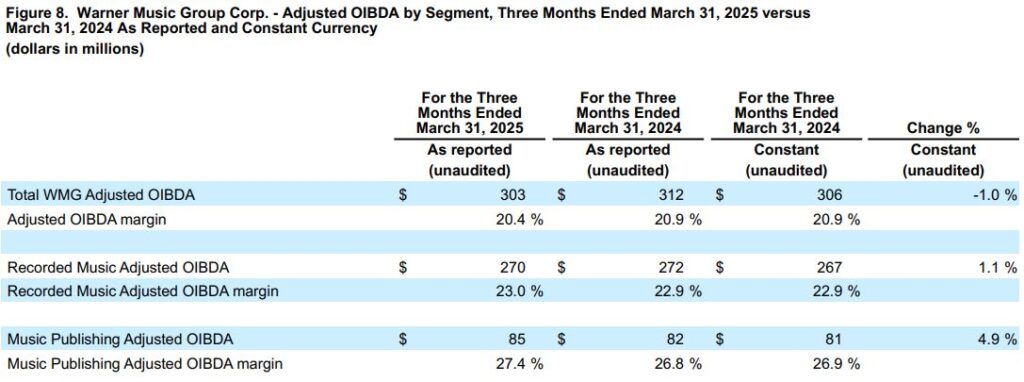

Adjusted OIBDA decreased 2.9% (or 1.0% in constant currency) to $303 million from $312 million and Adjusted OIBDA margin decreased 0.5 percentage points to 20.4% from 20.9% in the prior-year quarter (the same in constant currency). The decreases in Adjusted OIBDA and Adjusted OIBDA margin were primarily driven by revenue mix, partially offset by savings from the Strategic Restructuring Plan, a portion of which has been reinvested in the Company’s business.

Net income decreased 62.5% to $36 million from $96 million. The decrease in net income was due to the factors affecting Adjusted OIBDA described above, as well as the impact of exchange rates on the Company’s Euro-denominated debt resulting in a $34 million loss in the quarter compared to a $21 million gain in the prior-year quarter, and realized and unrealized losses on hedging activity of $6 million in the quarter compared to gains of $5 million in the prior-year quarter. The decrease was also driven by an $11 million increase in income tax expense due to the impact from winding down the Company’s owned and operated media properties in the prior-year quarter, partially offset by the impact of lower pre-tax income in the quarter.

Basic and Diluted earnings per share were $0.07 for both the Class A and Class B shareholders due to the net income attributable to the Company in the quarter of $36 million.

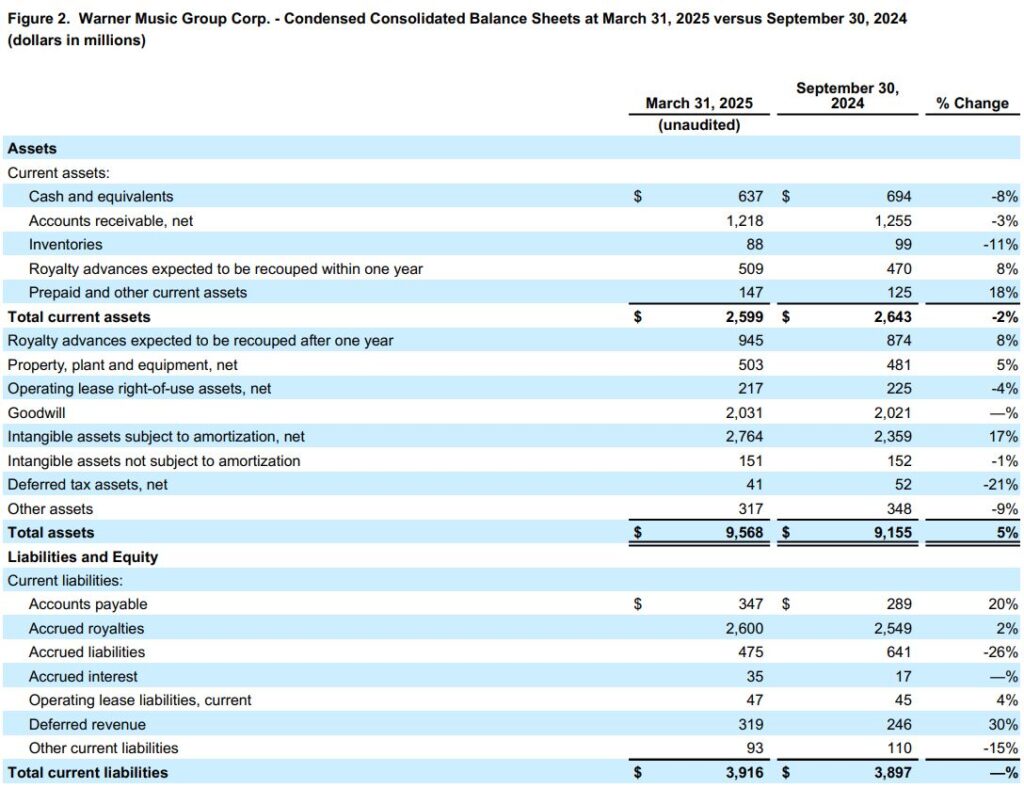

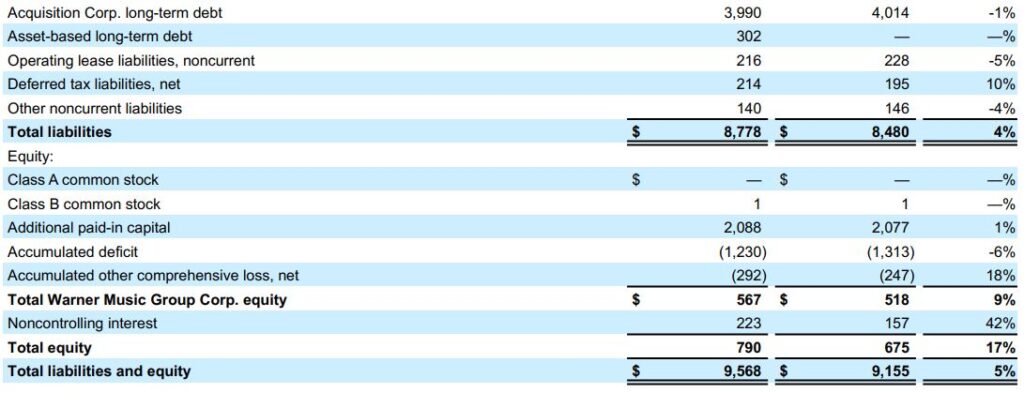

As of March 31, 2025, the Company reported a cash balance of $637 million, total debt of $4.292 billion and net debt (defined as total debt, net of deferred financing costs, premiums and discounts, minus cash and equivalents) of $3.655 billion. Total debt includes $302 million of subsidiary debt acquired in our acquisition of Tempo Music Holdings, LLC (“Tempo”). The debt is secured only by certain music rights owned by Tempo and is nonrecourse to the Company and its subsidiaries, other than Tempo.

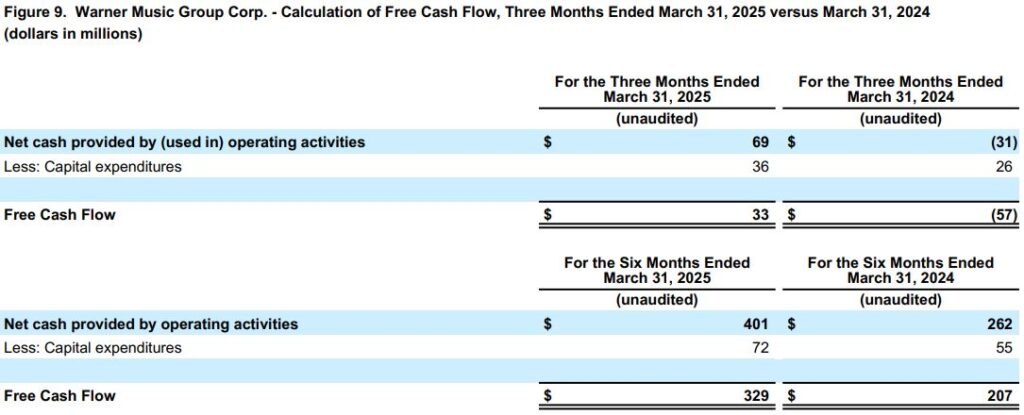

Cash provided by operating activities increased to $69 million in the quarter, compared to a use of $31 million in the prior-year quarter. The increase was largely a result of movements in deferred revenue due to timing of digital advances and other movements within working capital, including the timing of annual variable-compensation payments. Capital expenditures increased 38% to $36 million from $26 million in the prior-year quarter, driven by investments in technology. Free Cash Flow, as defined below, increased to $33 million from a use of $57 million in the prior-year quarter, primarily due to the factors affecting cash provided by operating activities described above.

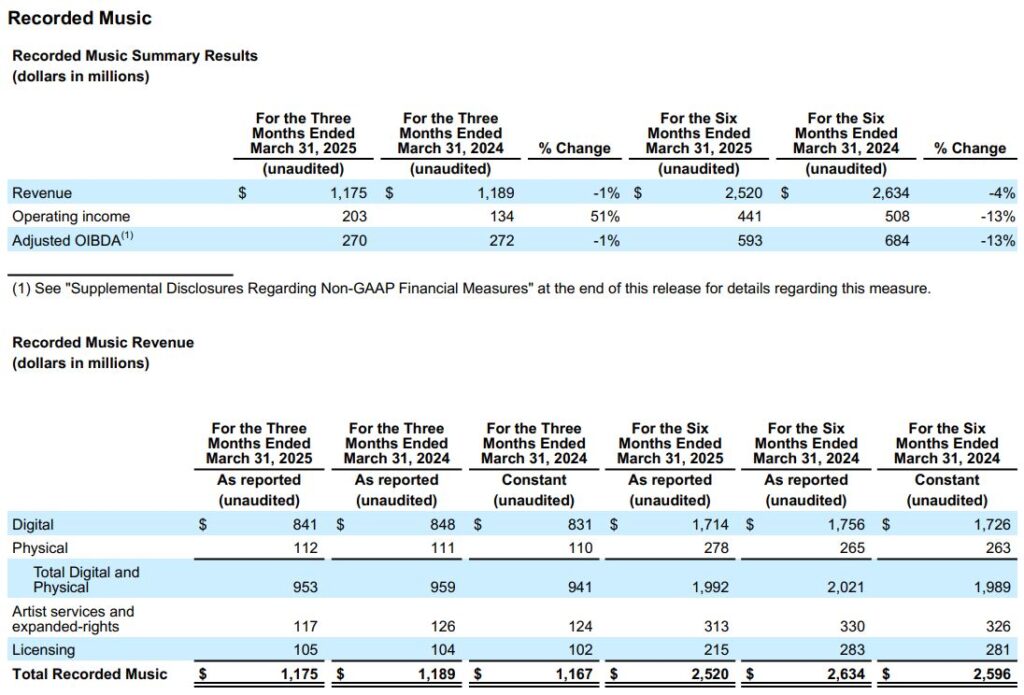

Recorded Music revenue was down 1.2% (or up 0.7% in constant currency) driven by decreases across digital and artist services and expanded-rights revenue, partially offset by growth in physical and licensing revenue. Digital revenue was down 0.8% (or up 1.2% in constant currency) and streaming revenue was down 0.4% (or up 1.6% in constant currency). Streaming revenue reflects growth in subscription revenue of 1.1% (or 3.2% in constant currency), partially offset by a decline in ad-supported revenue of 4.7% (or 2.9% in constant currency). Streaming revenue was impacted by a challenging year-over-year comparison, largely in subscription streaming revenue, compounded by a lighter release slate and market share loss in China. The decrease in ad-supported revenue was driven by a soft overall ad environment. Licensing revenue increased 1.0% (or 2.9% in constant currency), driven by licensing deals primarily in Japan and the U.S., partially offset by the timing of copyright infringement settlements. Artist services and expanded-rights revenue decreased 7.1% (or 5.6% in constant currency) due to lower concert promotion revenue primarily in France, lower direct-to-consumer merchandising revenue at EMP, and a decrease in revenue related to winding down the Company’s owned and operated media properties in the prior-year quarter. Physical revenue increased 0.9% (or 1.8% in constant currency) driven by new releases in the quarter, primarily in the U.S. and Japan, partially offset by the impact of the BMG Termination. Top physical sellers in the quarter included Mac Miller’s Balloonerism and new releases from ONE OK ROCK and TWICE.

Recorded Music operating income increased 51.5% (or 57.4% in constant currency) to $203 million from $134 million in the prior-year quarter, and operating margin was up 6.0 percentage points to 17.3% versus 11.3% in the prior-year quarter. The increase in operating income was due to the factors affecting Adjusted OIBDA discussed below, as well as a decrease in restructuring and impairment charges of $75 million compared to the prior-year quarter, which includes severance costs and impairment losses related to the Strategic Restructuring Plan in both periods, partially offset by higher non-cash stock-based compensation and other related expenses of $3 million in the quarter and higher amortization expenses of $1 million in the quarter attributable to acquisitions of music-related assets.

Adjusted OIBDA decreased 0.7% (or increased 1.1% in constant currency) to $270 million from $272 million and Adjusted OIBDA margin increased 0.1 percentage point to 23.0% from 22.9% in the prior-year quarter (the same in constant currency). The increases in constant currency Adjusted OIBDA and in Adjusted OIBDA margin were primarily driven by savings from the Strategic Restructuring Plan, of which a portion has been reinvested in the Company’s business, partially offset by revenue mix.

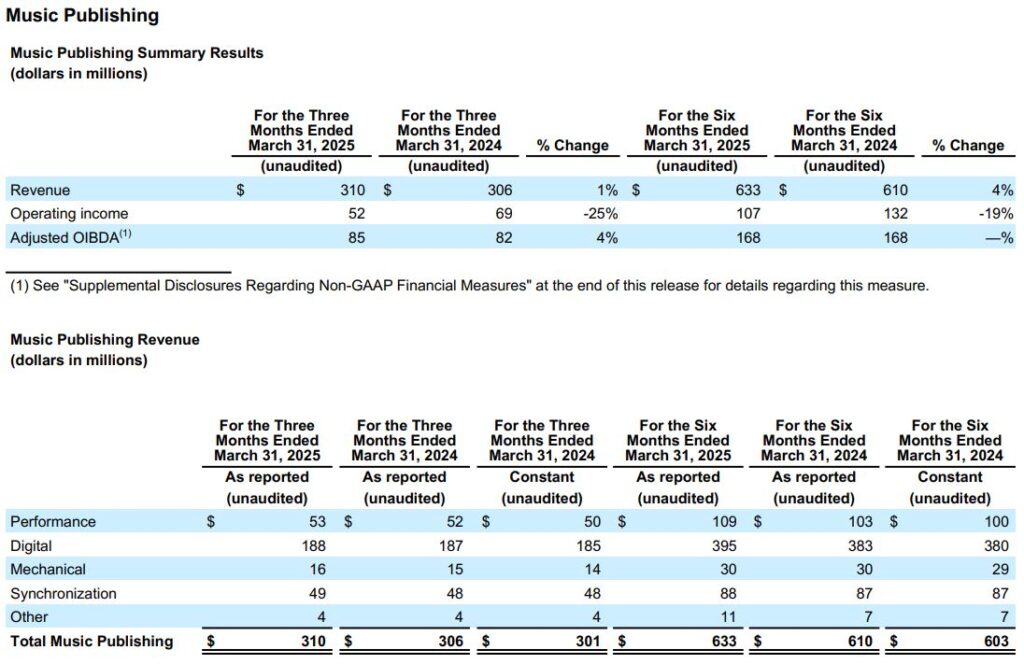

Music Publishing revenue increased 1.3% (or 3.0% in constant currency). The increase was driven by growth across digital, performance, synchronization and mechanical revenue. Digital revenue increased 0.5% (or 1.6% in constant currency) and streaming revenue was flat to the prior-year quarter (or increased 1.6% in constant currency), driven by the impact of digital deal renewals primarily in the U.S. Performance revenue increased 1.9% (or 6.0% in constant currency) attributable to growth from concerts, radio and live events primarily outside of the U.S. Synchronization revenue increased 2.1% (the same in constant currency) due to higher television and commercial licensing activity and the impact of acquisitions, partially offset by the timing of copyright infringement settlements. Mechanical revenue increased 6.7% (or 14.3% in constant currency), driven by higher physical sales in the quarter.

Music Publishing operating income decreased 24.6% (or 5.5% in constant currency) to $52 million from $69 million in the prior-year quarter and operating margin decreased 5.7 percentage points to 16.8% from 22.5% in the prior-year quarter. The decrease in operating income was driven by the same factors affecting Adjusted OIBDA discussed below, partially offset by the impact of a $14 million net gain on a divestiture of certain music publishing rights in the prior-year quarter and an increase in amortization expense of $4 million in the quarter related to various music publishing copyright acquisitions.

Music Publishing Adjusted OIBDA increased 3.7% (or 4.9% in constant currency) to $85 million from $82 million in the prior-year quarter. Adjusted OIBDA margin increased 0.6 percentage points to 27.4% from 26.8% in the prior-year quarter (or 0.5 percentage points to 27.4% from 26.9% in constant currency). The increases in Adjusted OIBDA and Adjusted OIBDA margin were primarily driven by revenue mix.

Financial details for the quarter can be found in the Company’s current Quarterly Report on Form 10-Q for the period ended March 31, 2025, which will be filed this morning with the Securities and Exchange Commission.

This morning management will be hosting a conference call to discuss the results at 8:30 A.M. EST. The call will be webcast on www.wmg.com.

About Warner Music Group

With a legacy extending back over 200 years, Warner Music Group today is home to an unparalleled family of creative artists, songwriters, and companies that are moving culture across the globe. At the core of WMG’s Recorded Music division are four of the most iconic companies in history: Atlantic, Elektra, Parlophone and Warner Records. They are joined by renowned labels such as TenThousand Projects, 300 Entertainment, Asylum, Big Beat, Canvasback, East West, Erato, FFRR, Fueled by Ramen, Nonesuch, Reprise, Rhino, Roadrunner, Sire, Spinnin’ Records, Warner Classics and Warner Music Nashville. Warner Chappell Music – which traces its origins back to the founding of Chappell & Company in 1811 – is one of the world’s leading music publishers, with a catalog of more than one million copyrights spanning every musical genre from the standards of the Great American Songbook to the biggest hits of the 21st century.

“Safe Harbor” Statement under Private Securities Litigation Reform Act of 1995

This communication includes forward-looking statements that reflect the current views of Warner Music Group about future events and financial performance. Words such as “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts” and variations of such words or similar expressions that predict or indicate future events or trends, or that do not relate to historical matters, identify forward-looking statements. All forward-looking statements are made as of today, and we disclaim any duty to update such statements. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them. However, we cannot assure you that management’s expectations, beliefs and projections will result or be achieved. Investors should not rely on forward-looking statements because they are subject to a variety of risks, uncertainties, and other factors that could cause actual results to differ materially from our expectations. Please refer to our Form 10-K, Form 10-Qs and our other filings with the U.S. Securities and Exchange Commission concerning factors that could cause actual results to differ materially from those described in our forward-looking statements.

We maintain an Internet site at www.wmg.com. We use our website as a channel of distribution for material company information. Financial and other material information regarding Warner Music Group is routinely posted on and accessible at http://investors.wmg.com. In addition, you may automatically receive email alerts and other information about Warner Music Group by enrolling your email address through the “email alerts” section at http://investors.wmg.com. Our website and the information posted on it or connected to it shall not be deemed to be incorporated by reference into this communication.

Supplemental Disclosures Regarding Non-GAAP Financial Measures

We evaluate our operating performance based on several factors, including the following non-GAAP financial measure:

Adjusted OIBDA

We evaluate our operating performance based on several factors, including our primary financial measure of operating

income (loss) before non-cash depreciation of tangible assets and non-cash amortization of intangible assets adjusted to

exclude the impact of non-cash stock-based compensation and other related expenses and certain items that affect

comparability including but not limited to gains or losses on divestitures and expenses related to restructuring and

transformation initiatives (“Adjusted OIBDA”). We consider Adjusted OIBDA to be an important indicator of the operational

strengths and performance of our businesses. However, a limitation of the use of Adjusted OIBDA as a performance

measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in

generating revenues in our businesses. Accordingly, Adjusted OIBDA should be considered in addition to, not as a

substitute for, operating income (loss), net income (loss) attributable to Warner Music Group Corp. and other measures of

financial performance reported in accordance with United States generally accepted accounting principles (“U.S. GAAP”).

In addition, our definition of Adjusted OIBDA may differ from similarly titled measures used by other companies.

Constant Currency

As exchange rates are an important factor in understanding period-to-period comparisons, we believe the presentation of

revenue and Adjusted OIBDA on a constant-currency basis in addition to reported results helps improve the ability to

understand our operating results and evaluate our performance in comparison to prior periods. Constant-currency

information compares revenue and Adjusted OIBDA between periods as if exchange rates had remained constant period

over period. We use revenue and Adjusted OIBDA on a constant-currency basis as one measure to evaluate our

performance. We calculate constant-currency by calculating prior-year revenue and Adjusted OIBDA using current-year

foreign currency exchange rates. Revenue and Adjusted OIBDA on a constant-currency basis should be considered in

addition to, not as a substitute for, revenue and Adjusted OIBDA reported in accordance with U.S. GAAP. Revenue and

Adjusted OIBDA on a constant-currency basis, as we present them, may not be comparable to similarly titled measures

used by other companies and are not a measure of performance presented in accordance with U.S. GAAP.

Free Cash Flow

Our definition of Free Cash Flow is defined as cash flow provided by operating activities less capital expenditures. We use

Free Cash Flow, among other measures, to evaluate our operating performance. Management believes Free Cash Flow

provides investors with an important perspective on the cash available to fund our debt service requirements, ongoing

working capital requirements, capital expenditure requirements, strategic acquisitions and investments, and any

dividends, prepayments of debt or repurchases or retirement of our outstanding debt or notes in open market purchases,

privately negotiated purchases, any repurchases of our common stock or otherwise. As a result, Free Cash Flow is a

significant measure of our ability to generate long-term value. It is useful for investors to know whether this ability is being

enhanced or degraded as a result of our operating performance. We believe the presentation of Free Cash Flow is

relevant and useful for investors because it allows investors to view performance in a manner similar to the method

management uses.

Free Cash Flow is not a measure of performance calculated in accordance with U.S. GAAP and therefore it should not be

considered in isolation of, or as a substitute for, net income (loss) as an indicator of operating performance or cash flow

provided by operating activities as a measure of liquidity. Free Cash Flow, as we calculate it, may not be comparable to similarly titled measures employed by other companies. In addition, Free Cash Flow does not necessarily represent funds

available for discretionary use and is not necessarily a measure of our ability to fund our cash needs. Because Free Cash

Flow deducts capital expenditures from “net cash provided by operating activities” (the most directly comparable U.S.

GAAP financial measure), users of this information should consider the types of events and transactions that are not

reflected. We provide below a reconciliation of Free Cash Flow to the most directly comparable amount reported under

U.S. GAAP, which is “net cash provided by operating activities.”